La Impact Weekly | July 07: SHEIN gets fined, again, Veja's repair service, and more EU moves

Hello sustainable fashion enthusiasts,

Welcome to this week’s edition of La Impact Weekly, your sustainable fashion download.

Here’s a quick recap (full details below):

Brand & Industry Initiatives

🫒 Veja expands repair service with Prolong across France

🫒 Minnetonka launches Reclamation Collaborative with Native American artists

🫒 Farm Rio launches first US resale programme “Closet to Closet”

Gabriela Hearst debuts recycled denim with low-impact dyeing

Princess Polly achieves B Corp certification

BGMEA and WRAP renew ethical manufacturing partnership

Fashion Tech & Sustainability Innovation

Positive Luxury and Buyerdock team up on digital product passports

Lycra presents renewable elastane fiber at Milano Unica

Standards & Regulatory Shifts

France fines SHEIN €1.1Mn for deceptive pricing and microplastic violations

France proposes €150M fine to SHEIN for illegal tracking cookies

California settles with SHEIN over shipping violations for $700k

EU scraps deforestation country risk ranking

EU launches roadmap for nature credits market

EU eases sustainability taxonomy compliance

EFRAG proposes major cuts to CSRD datapoints

UK considers banning PFAS in school uniforms

California publishes Scope 1–3 climate disclosure guidance

Investigations & Reports

Bain warns only 11% of fashion is on track for 2030 climate targets

BSI study reveals consumer trust gap in circular fashion

Resources

Deloitte launches Fashion Impact Toolkit for CSRD

Podcast: Arc’teryx brings in-store repairs to London

SHEIN under attack, again

La Backdrop

SHEIN is part of our featured news for the second week in a row.

After years of riding high with rock-bottom prices and murky sourcing, the walls are closing in. The ultra-fast fashion giant first tried to IPO in New York back in late 2023, but regulators weren’t having it. Allegations of forced labor, massive data privacy failures, and ongoing investigations made SHEIN too hot for Wall Street.

So they tried London in early 2025. Same story: UK regulators asked for more transparency, more labor assurances, more oversight. SHEIN couldn’t deliver, and the listing stalled.

Now? In mid-2025, they’ve quietly filed in Hong Kong, under a confidentiality waiver. China reportedly nudged them to stay local, even as SHEIN courts global investors. They’ve also been testing the waters in Vietnam and Brazil to diversify supply chains and reduce reliance on China, but they’re walking a tightrope.

Meanwhile, in a very obvious PR cleanup, SHEIN has been scrambling to rebrand. They got their climate targets approved by the Science Based Targets initiative (SBTi). They partnered with Donghua University to pilot chemical recycling of polyester. They threw millions at Ghana’s Kantamanto market (the same one flooded with discarded fast fashion in the first place).

It’s giving: “We’re not that bad anymore!”

But governments aren’t buying it.

As a recap:

April 2024: $14k settlement in California over DEHP in handbags (Prop 65).

March 2025: Additional Prop 65 settlement (DEHP in kids’ rain boots), amount undisclosed.

May 2025: The European Commission issued a formal warning to SHEIN for systemic consumer protection violations including dark patterns, fake discounts, and misleading sustainability claims. No fine yet, but potential penalties could reach 4% of EU annual turnover per country.

July 3, 2025: France’s DGCCRF fined Infinite Style E-Commerce Co Ltd, SHEIN’s EU subsidiary, €40Mn ($47.1Mn USD) for deceptive pricing practices.

July 4, 2025: French regulators also fined SHEIN €1.1Mn for failing to disclose that over 730 products release microplastics during washing, as required under France’s new environmental labeling rules.

Los Details

SHEIN gets fined this week, again.

July 10, 2025: France’s CNIL proposed a €150Mn fine ($175M USD) for illegally installing advertising cookies, tracking users after they opted out, and using misleading consent banners. Still pending.

July 10, 2025: In California, district attorneys from Napa, LA, San Francisco, and Sonoma counties reached a $700k settlement with SHEIN for violating shipping delay laws.

For those keeping track, fees are starting to add up to about $200Mn.

Oh, and France? They’re just getting started. In June 2025, the French Senate passed a sweeping anti–fast fashion law that bans advertising from platforms like SHEIN and Temu, and introduces a €5 per-item tax in 2025 (rising to €10 by 2030) for products with the worst environmental scores.

Mi Take

This is no longer a slap on the wrist. It’s a menace to their business model.

Analysts have slashed SHEIN’s valuation. Once rumored to be worth $100Bn, now closer to $45-60Bn, reflecting regulatory risks, mounting fines, and investor skepticism.

SHEIN built its empire on viral marketing, and offloading social and environmental costs onto everyone else. But now? Those externalities are getting priced in. And it’s not cheap.

France alone has hit them with over €191 million in confirmed and proposed penalties in a single month. California is having its shot. We will likely hear more from the EU. For a company making an estimated $1.5 billion in annual profit, this is no longer noise. These fines are hitting margins.

And all of it… right before a potential IPO? Terrible timing. Or maybe… incredible timing.

One thing that I noticed is that I’m not hearing much about Temu. Are they next? Or is SHEIN only here to set an example with no follow through?

And, I wonder: Is it finally becoming too expensive to dump the costs of doing business on the planet and people?

Let’s see. But this month is starting to feel like a turning point.

What do you think? Is SHEIN’s business model no longer feasible given tariffs and regulatory risks? Why aren’t we hearing as much from other fast fashion companies?

Brand & Industry Initiatives

🫒 Veja partners with Prolong for tech-enabled repair service. The sustainable sneaker brand launched a new after-sales service across France with plans for global expansion, giving customers transparent tracking from drop-off to re-delivery. The service soft-launched in March and aims to manage all French after-sales requests by year-end, with over 50,000 pairs repaired since Veja began investing in in-house aftercare. Read more.

🫒 Minnetonka launches Reclamation Collaborative with Native artists. The Minnesota-based footwear company created an initiative led by reconciliation advisor Adrienne Benjamin to redesign previously appropriated styles and develop authentic Indigenous designs. Read more.

🫒 Farm Rio launches first US resale programme “Closet to Closet.” The Brazilian lifestyle brand partners with Poshmark to sync and auto-list pre‑loved Farm Rio pieces from customers’ purchase history (listing only requires owner approval), and with ThredUp to accept gently worn items for resale in exchange for Farm Rio gift cards. Read more.

Gabriela Hearst debuts 100% recycled denim collection. The luxury brand launched its first recycled cotton denim line, previewed at Paris Fashion Week A/W 2025, featuring sustainable dyeing processes that reduce electricity consumption and use filtered, reused water. Read more.

Princess Polly achieves B Corp certification. The Australian-US fashion label completed a two-year evaluation process to meet B Corp standards. But, they many consider them a fast fashion company, rated “Not Good Enough” on Good on You, and this latest move as giving them tools for greenwashing. Read more.

Fashion Tech & Sustainability Innovation

Positive Luxury partners with Buyerdock on digital product passports. The sustainability certification platform teamed up with the digital compliance platform to help Butterfly Mark accredited brands adopt DPP technology for upcoming EU regulations. Read more.

Lycra Company showcases bio-derived fiber at Milano Unica. The company presented LYCRA® bio-derived EcoMade fiber, the world's first renewable elastane available at commercial scale made with 70% renewable materials including field corn. Read more.

Standards & Regulatory Shifts

EU lawmakers reject EUDR country risk system. European Parliament voted to reject the benchmarking system categorizing countries by deforestation risk under the EU Deforestation Regulation, citing outdated data and insufficient risk categories. Read more.

EU launches nature credits market roadmap. The European Commission announced plans to develop a nature credits market similar to carbon credits, enabling farmers and foresters to fund biodiversity protection through private capital flows from companies meeting sustainability goals. Read more.

EU simplifies sustainability taxonomy to reduce compliance burden. The European Commission adopted measures to streamline the EU Taxonomy framework, introducing a materiality threshold where activities accounting for less than 10% of revenue, capex, or operating expenses are considered non-material for non-financial companies. Read more.

EFRAG proposes 66% cut to EU sustainability reporting requirements. The European Financial Reporting Advisory Group revealed plans to drastically reduce ESRS datapoints under the EU's CSRD regulation, eliminating all voluntary "may" disclosures and cutting mandatory requirements by over 50%. Read more.

UK considers banning PFAS in school uniforms. The House of Lords is reviewing amendments to the Children's Wellbeing and Schools Bill that would ban "forever chemicals" from school uniforms, with one amendment calling for immediate prohibition and another requesting action within 12 months on artificial fibres posing health risks. Read more.

California publishes climate reporting guidance. California's Air Resources Board released an FAQ to guide companies preparing for mandatory climate disclosure laws affecting large U.S. businesses. Companies with $1Bn+ revenue must report Scope 1-3 emissions starting 2026-2027, while those with $500Mn+ revenue must disclose climate-related financial risks by January 2026. Read more.

Decarbonizing Fashion: How to Align Impact with Business Value

Only 11% of fashion's market value is on track to meet 2030 climate targets

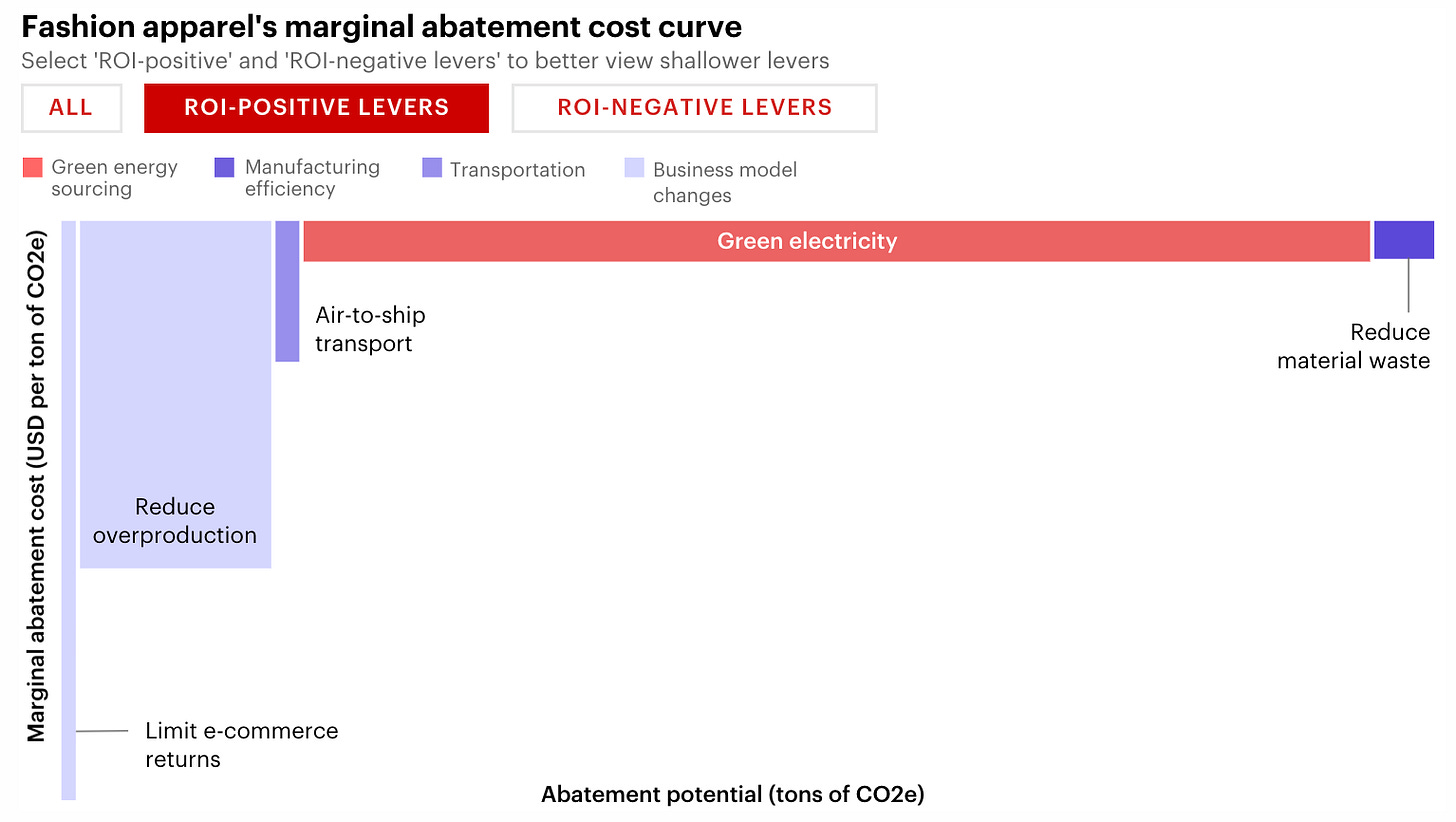

Based on Bain's analysis of fashion industry decarbonization strategies, the sector faces a massive gap between climate ambitions and reality. Key findings include:

Fashion apparel must prioritize AI forecasting, green electricity, and decrease waste

Luxury should focus on reducing 40% overproduction rates and scaling profitable resale

60% of fashion brands are testing AI-powered sales forecasting

Long-term supplier contracts are needed to enable transitions

Upcoming EU regulations requiring digital product passports (DPP) could unlock new possibilities. Imagine a one-click resale button or automated buy-back by the brand. Tools are coming, and early movers will benefit.

What it means: The clock is ticking. For most brands, chasing recycled polyester or other materials sounds exciting, but does not make sense. Instead, start fixing “boring stuff” that has high ROI and decarbonization potential. This will help you gain traction internally to then go do the harder stuff. Examples of levers to explore include: AI demand forecasting, renewable energy contracts, resale, and reduce material waste. Winners won’t only reduce regulatory risk and achieve savings, but will also have access to the small pool of verified sustainable suppliers, with locked-in rates (with projected demand outpacing supply by 133Mn tonnes). Losers risk paying a steep reputational, regulatory, and profit price.

Read more. Also, suggest this great report with more details focused on Tier 2 from McKinsey.

BSI - The Tipping Point: Building Trust in the Circularity Economy

67% of consumers want sustainable fashion but only 35% actually buy it

Based on BSI's global study of 8k+ consumers in partnership with Cambridge Institute for Sustainability Leadership, the fashion industry faces a massive trust barrier. Key findings:

The massive say-do gap:

67% of people globally cite environmental benefits as a top-three driver for adopting circular behaviors, only 35% are willing to buy secondhand clothing

53% identify as early adopters of circular habits but purchase rates are far below

Share of re-used materials entering the global economy has fallen from 7.2% to 6.9% in recent years

Fear factor drives the gap:

Over half of respondents feared compromising on product quality (56%), safety (51%), and reliability (49%) in the case of reused or repaired products

Lack of trust in environmental claims is "a barrier" to purchasing circular products for a third of people (32%)

59% said a recognised label to support claims would build trust

Brand expectations vs. reality:

42% of UK consumers anticipate luxury brands being able to use sustainable materials, and globally there are expectations from 40% for luxury to 29% for low-price online retailers (which is not that different between them)

Number of consumers willing to spend more than £200 on a sustainably produced product is almost equal to those who will spend the same on a traditional product

This disconnect, (…) the “say-do gap,” is compounded by (…) the “fear factor.”

What this means: There needs to be a focus on trust: authentication and ensuring high-quality resale items via brand resale sites, trustworthy and well-known certifications, and transparency in claims, which may be enabled with support from digital product passports

Podcasts

"It's a No-Brainer": Arc'teryx on Bringing Repairs In-Store

This episode of The Circular Economy Show visits Arc'teryx's London flagship store to see how the outdoor brand transformed retail by integrating free repair services directly in-store. The episode explores their ReBIRD service center and interview Katie Wilson, Director of Social and Environmental Sustainability, about the strategic shift from linear to circular business models. Personally, I thought it was refreshing to hear about how brands make it happen, and deliver on win-win sustainability initiatives.

Tools

Deloitte Global Fashion Impact Toolkit

A free resource from Deloitte Global and Global Fashion Agenda helping fashion companies navigate sustainability impacts across their value chain. The toolkit outlines nearly 3k potential impacts across value chain stages to help inform leaders' decision-making. 80% of product environmental impacts are determined at the design stage, making early intervention crucial. The interactive platform maps stages from material production through end-of-life, structured around European Sustainability Reporting Standards (ESRS). Designed for upcoming regulations like CSRD and CSDDD, it supports materiality assessments, supplier collaboration, and strategic sustainability planning. Access the interactive tool here, and read the report here.

Last week started with a trip to LA where I led a training session on responsible sourcing for a local brand. I saw ICE pick up a man walking on the street and at least 20 military trucks on the highway. Downtown LA was peaceful otherwise.

From the training itself, I will share 2 key takeaways: 1) it helps to bring someone from the outside to move an organization along, and 2) everyone in most brands want to be more sustainable, it is all about defining how they can do that in their day-to-day. For more on this, check out this how-to guide based on EILEEN FISHER's journey to become a fully sustainable brand.

Then, I had the life of an aunt. I went to San Francisco to meet my best friend's baby, who is oh-so-cute. I changed diapers, which means I can officially claim the "aunt" title. I was lucky to be in the neighborhood of the SF Art Book Festival, where I bought not one, or two, but FOUR books about graphic design. I am always looking for inspiration.

This week, I am all in on finding a co-founder to continue on the journey with Alu, my startup focused on helping SME brands become more sustainable. If you know of a bad-a** full-stack dev looking to change the world, you know where to find me!

Let’s become friends, you can find me on LinkedIn.

What keeps you up at night? Tell me by filling out the survey, and I will cover it next.

Subscribe to La Purpose Brand. 🫒