La Impact Weekly | June 30: France fines SHEIN for deceptive practices, Seaweed Crochet Dresses, and Cinnamon Shoes

Hello sustainable fashion enthusiasts,

Welcome to this week’s edition of La Impact Weekly, your sustainable fashion download. This week you’ll find:

Brand & Industry Moves

& Other Stories launches seaweed-based crocheted set.

Stella McCartney launches compostable sneakers.

Prada admits Kolhapuri inspiration, proposes collaboration after controversy.

Circ and Zalando launch collection with recycled Circ Lyocell.

Textile Exchange recalibrates strategy for 2030 impact.

Fashion Tech & Sustainability Innovation

Mango invests in The Post Fiber for post-consumer textile recycling.

Korvaa unveils bio-based shoe made from mycelium and bacterial nanocellulose.

Altri acquires majority stake in AeoniQ for biodegradable filament yarn.

Bambrew raises $10.3M for bamboo packaging solutions.

Regulatory & Policy Shifts

France fines Shein €40Mn for deceptive business practices.

EU extends CSRD standards deadline to November 30.

EU proposes 90% emissions reduction by 2040.

EU clarifies Green Claims Directive not withdrawn.

Norway sets 70-75% emissions reduction target by 2035.

GRI releases draft labor-focused sustainability standards.

OECD approves GOTS due diligence framework.

ISSB launches SASB sector-focused standards update.

Investigations & Reports

IPCC reveals 3x+ carbon differences across textile production regions.

UKFT proposes UK textile recycling hub for 720 jobs, £53M GDP impact.

Resources

Wardrobe Crisis explores Kantamanto market recovery after fire.

The Circular Economy Show features H&M's circular business models.

France fines Shein €40Mn for deceptive business practices

La Backdrop

SHEIN does not seem to get a break. And I am all here for it. Who isn't?

SHEIN has faced a series of accusations from across Europe: Italy's Competition Authority launched a greenwashing investigation in September 2024 over alleged misleading environmental messages, the BEUC filed a complaint with the European Commission in June 2025 over "dark patterns" designed to make people buy more, and the EU issued a formal warning in May 2025 accusing Shein of widespread consumer protection violations across Belgium, France, Ireland, and the Netherlands, giving the company until June 26, 2025 to comply or face fines of at least 4% of annual sales in each affected country.

France also seems to be going after the fast fashion giant. Just four weeks ago, France's Senate approved an anti-fast fashion law that would ban advertising by platforms like Shein and impose taxes of up to €5 per product in 2025, rising to €10 by 2030, for items with the lowest environmental scores. The bill passed the Senate with 337 votes for and only one against, showing France's overwhelming political consensus against ultra-fast fashion.

Los Details

France's antitrust agency fined Infinite Style E-Commerce Co Ltd, which handles sales for the Shein brand, €40Mn ($47.17Mn) for deceptive business practices, and the company has accepted the fine. The investigation was conducted under Article 112-1-1 of the French Consumer Code, which requires that discount reference prices correspond to the lowest price offered to consumers in the 30 days preceding the price reduction.

Key violations found during the nearly year-long probe:

57% of advertised deals offered no actual price reduction

19% provided smaller discounts than advertised

11% were actually price increases disguised as sales (what?!?!?!)

The investigation also covered misleading environmental impact claims. Shein claims it addressed all issues over a year ago after being notified in March 2024, stating "all identified issues were addressed more than a year ago".

Mi Take

This €40Mn fine represents more than just punishment for fake discounts: it's France continuing its crusade against fast-fashion. This is great news given recent moves that made me wonder if France was still committed to sustainability (mainly how in May 2025, President Macron urged the EU to completely repeal CSDDD).

The fact that nearly 68% of Shein's "deals" weren't actually discounts says what we all know about SHEIN's business model: that it is based on consumer manipulation (along with supply chain exploitation, of course).

With France's new anti-fast fashion law looming, the de minimis exemption being removed in the US in 2027, and multiple EU investigations closing in, Shein faces an existential challenge. And they know it, which is why they have been rushing to change their image by getting their climate targets SBTi approved (what a joke), investing in recycled polyester, and secretly filing for a Hong Kong IPO after failing to do it in NYC and London.

But everyone can see through the BS.

What do you think? Time to celebrate?

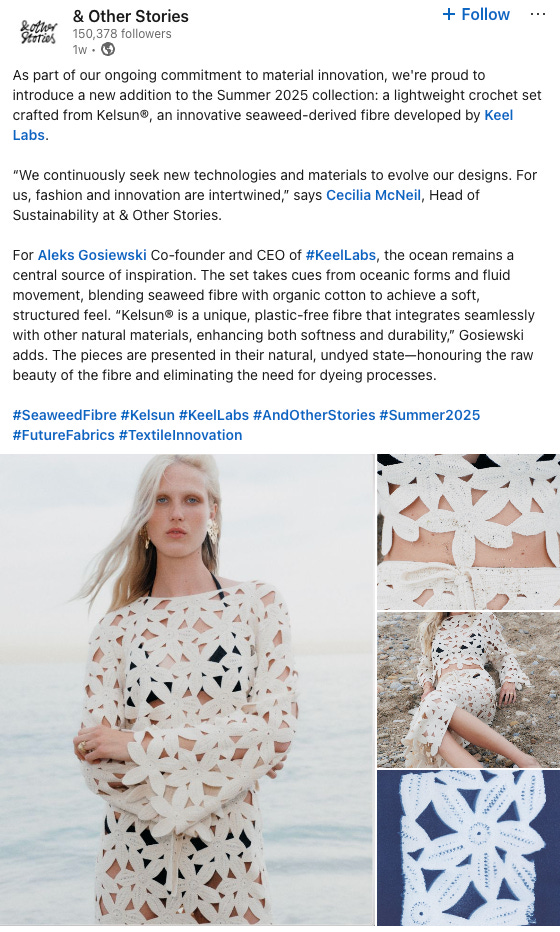

Brand & Industry Initiatives

& Other Stories launches seaweed-based crocheted set. The H&M Group-owned label partnered with Keel Labs to create a boho crocheted top and skirt made from Kelsun, a plastic-free, bio-based fiber derived from seaweed. The set features 70% cotton and 30% Kelsun, with no dyes used to maintain the material's natural color. Keel Labs scaled production 10 times over in 2024, with Kelsun winning "Innovation of the Year" from Textile Exchange and being featured in collections by Stella McCartney and Outerknown. Read more.

Stella McCartney launches compostable sneakers. The S-Wave Sport Trainer features BioCir Flex soles made from castor beans and dyed using cinnamon waste, creating a fully compostable and recyclable sneaker that actually smells like spice. Developed with Israeli startup Balena, the $550 shoe represents a breakthrough in circular design, offering the same performance as conventional plastic while being able to break down at end of life. Read more.

Circ and Zalando launch first collection with recycled lyocell. The European platform's Anna Field label dropped a blouse ($35) and dress ($75) made from 100% Circ Lyocell containing 40% recycled polycotton textile waste. The launch marks Zalando's first consumer offering with the Circ. Read more.

Prada admits Kolhapuri inspiration, proposes collaboration. Prada officially confirmed that sandals showcased in its recent men's fashion show were inspired by traditional Indian Kolhapuri sandals, following complaints over cultural misappropriation. The controversy emerged from the stark pricing disparity: local artisans craft authentic Kolhapuri chappals for 400 Indian rupees while Prada reportedly sold its version for over 100k+ Indian rupees. Prada has now proposed co-branding discussions. Read more.

Textile Exchange recalibrates for 2030 impact. The global non-profit unveiled a streamlined five-year strategy focused on systems change, moving away from consensus-building toward collective accountability. The organization admitted that despite 90k certified sites globally, the fashion sector remains off track to meet the 45% reduction in greenhouse gas emissions from fiber production required by 2030. The refreshed approach emphasizes Tier 4 producers and farmers, introducing the unified "Materials Matter" certification framework to replace fragmented standards. Read more.

Fashion Tech & Sustainability Innovation

Mango invests in post-consumer textile recycling. The Spanish fashion retailer became the first major brand to invest in The Post Fiber, a startup that transforms post-consumer textile waste into new fibers. Through its Mango StartUp Studio accelerator, the company launched a limited-edition Mango Teen collection featuring 10 items made from 80% recycled material, with 15% from The Post Fiber's post-consumer waste and 65% from post-industrial waste. Read more.

Korvaa unveils fully bio-based concept shoe. The Korvaa Consortium presented an innovative shoe at the 2025 Future Fabrics Expo in London, made entirely from mycelium, bacterial nanocellulose, and biodegradable plastics. The collaboration cut typical shoe components from 30+ to just 5 materials. Modern Synthesis created the upper from bacterial nanocellulose, Ourobio used biodegradable PHAs for the base, and Ecovative grew the sole using mycelium. Read more.

Altri acquires majority stake in AeoniQ. Portuguese cellulosic pulp producer Altri signed an agreement to acquire a majority stake in AeoniQ, a Swiss cleantech spin-off that developed the world's first climate-positive, biodegradable filament yarn to replace polyester and nylon. The first industrial plant will be built at Altri's Caima pulp mill in Portugal, with construction beginning in 2026 and initial capacity of 1,750 tons per year. Read more.

Bambrew raises Rs. 90 crore for bamboo packaging. Bengaluru-based sustainable packaging startup Bambrew secured Rs. 90 crore ($10.3Mn) in funding. The company serves 500+ customers including Shoppers Stop, Snitch, Nicobar, Puma, and Global Desi. Bambrew creates eco-friendly packaging from bamboo fiber, seaweed, agro-waste, and recycled paper as home-compostable alternatives to single-use plastic. Read more.

Standards and Regulatory Shifts

EU extends deadline for simplified CSRD standards. The European Commission pushed back the deadline for EFRAG to complete revisions of the European Sustainability Reporting Standards to November 30 (from October 31, 2025). The revision is part of the Commission's Omnibus I package. EFRAG had only 7 months to develop technical advice for streamlining the standards. Read more.

EU proposes 90% emissions reduction by 2040. The European Commission proposed a binding 90% cut in GHG emissions by 2040 compared to 1990 levels, bridging the current 55% reduction goal by 2030 and climate neutrality by 2050. The proposal includes flexibilities allowing international carbon credits from developing countries to meet up to 3% of the target from 2036. Read more.

EU clarifies anti-greenwashing law not withdrawn. The European Commission clarified that the Green Claims Directive has not been withdrawn, despite earlier statements suggesting withdrawal following pressure from the European People's Party. The confusion arose over microenterprise exemptions (businesses with <10 employees representing 96% of EU companies). The Commission said it would only withdraw if microenterprises remained in scope, citing administrative burden. Read more.

Norway sets 70-75% emissions reduction target. The Norwegian government announced a climate target to reduce economy-wide greenhouse gas emissions by 70-75% below 2019 levels by 2035. The goal will form Norway's new Nationally Determined Contribution under the Paris Agreement, achieved through domestic measures and EU cooperation. Policy instruments include carbon taxation, emissions trading, climate-related public procurement, and financial support for technologies like carbon capture. Read more.

GRI releases draft labor-focused sustainability standards. GRI releases draft labor reporting standards. The Global Reporting Initiative launched two new draft standards covering anti-discrimination measures and worker human rights protections as part of its broader Labor Project to revise eight labor-related standards. Public comments close September 15, 2025, with final publication expected from mid-2026. Read more.

OECD approves GOTS due diligence framework. OECD finds GOTS largely aligned with supply chain guidance. The OECD assessed Global Organic Textile Standard's version 7.0 due diligence frameworks against its garment sector guidelines, finding 69% of GOTS' 167 criteria fully aligned and 29% partially aligned. Only 2% showed no alignment with OECD's responsible supply chain standards. Read more.

ISSB launches SASB sector-focused standards update. The International Sustainability Standards Board released exposure drafts updating sector-focused SASB reporting standards for oil and gas, metals and mining, construction materials, and processed foods. The review seeks to align SASB with ISSB's climate frameworks and improve compatibility with GRI and TNFD standards. Read more.

IPCC Cost and Carbon Data of 2023

There is a 3x+ carbon difference between cleanest and dirtiest textile production regions

Based on the International Production Cost Comparison (IPCC) report from ITMF covering 2023 data, the textile industry shows dramatic cost and carbon footprint variations across global production centers. Key findings include:

Massive carbon footprint differences exist across production centers:

India has the highest emissions with 12.5+ kg CO₂e per kg

Brazil achieves lowest at under 4 kg CO₂e per kg

China shows high finishing emissions at 3.9 kg CO₂e

Energy source drives the biggest differences:

Brazil's renewable energy mix enables dramatically lower emissions

India's high-intensity spinning (4.4 kg) and weaving (4.3 kg) stages drive total footprint

Process efficiency matters: US and Italy show low early-stage emissions

Production stage matters as much as location:

Finishing processes are energy-intensive across markets

Spinning and weaving create the highest emissions in major producers

Uzbekistan shows moderate emissions with improvement potential

What it means: The 3x+ carbon gap is huge. If you have climate targets, especially 2030 commitments, you need to start working with your sourcing team now. Either specify low-carbon production regions OR invest in renewable energy across your existing supply chain. And do it now. Early movers will lock in cleaner suppliers before competitors do, while late adopters risk being stuck with high-emission partners or paying hefty prices. Because, remember: By 2030, the fashion industry is projected to face a 133Mn tonne shortfall in low-carbon textiles. Read more.

A vision for a textile recycling hub in the UK

A textile recycling hub in the UK would support 720 jobs and contribute around £53Mn to GDP annually

UKFT has launched a comprehensive vision for establishing the UK's first national textile recycling hub, developed by Oxford Economics. The proposal outlines a phased plan to build large-scale textile recycling infrastructure over the next decade, anchored by three Automatic Textile Sorting Plants and a chemical recycling facility. Key Takeaways:

The hub would divert nearly 150,000 tonnes of textile waste from landfill and incineration annually, with 50,000 tonnes chemically recycled into new clothing fibers.

Construction over 4 years could support 620 job years and add £46Mn in Gross Value Added to the UK economy.

Once operational, the hub would support 720 jobs and contribute around £53Mn to GDP annually.

The initiative could save more than £24Mn annually in avoided landfill and incineration gate fees

East Midlands, North West and South West identified as potential host regions, with East Midlands housing the chemical recycling plant

1Mn tonnes of used textiles are currently discarded annually in the UK, costing around £200Mn in disposal fees

What it means:

There is certainly potential here with disposal costs reaching £200Mn per year and ~1/3 of textiles ending up in landfill or incinerated. For fashion brands facing increasing pressure to close the loop, this hub could provide the missing infrastructure needed to make textile-to-textile recycling commercially viable at scale. Read more.

Podcasts

Update After the Kantamanto Fire - Resilience, Creativity, Community

This episode of Wardrobe Crisis checks in on Ghana's Kantamanto market six months after a devastating fire. Host Clare Press talks with The Or Foundation's Liz Ricketts and community members Mary and Latifa about rebuilding after flames destroyed most of this massive second-hand clothing market. While the physical structure is back with improvements like electricity and fire safety training, deeper issues around waste and working conditions persist. A story of community resilience in fashion's global waste crisis.

How H&M Group is exploring circular business models in The Fashion ReModel

This episode of The Circular Economy Show dives into H&M Group's work with the Ellen MacArthur Foundation's Fashion ReModel project. Host Pippa talks with Chloe Holland from the Foundation and Sara Eriksson from H&M Group about scaling circular business models like resale, rental, and repair. They discuss H&M's Sellpy resale platform and the challenges of applying circular principles in a linear economy. The conversation touches on policy and finance needed to make these models commercially viable at scale.

Last week I spent time in Austin being an aunt and doing all the classic aunt things: reading children's books, telling bed time stories (more like trying to remember bedtime stories and changing them to be more “21st century”), visiting the library, and playing a game my niece invented where we run, fall, and rolled on the grass.

I'm also going through a team transition period with my startup. It was a tough and sad choice, but definitely the right thing to do. Such is life as a startup founder. The main learning is to force myself to make those decisions sooner.

Let’s become friends, you can find me on LinkedIn.

What keeps you up at night? Tell me by filling out the survey, and I will cover it next.

Subscribe to La Purpose Brand. 🫒